Ideal Tips About What Is Arima Vs Garch Model Draw A Line Chart

If the series of conditional variances were observable, you could apply arima on it.

What is arima vs garch model. Arima is a fundamental time series model. However, conditional variances are not observable, so you. I am currently working on arma+garch model using r.

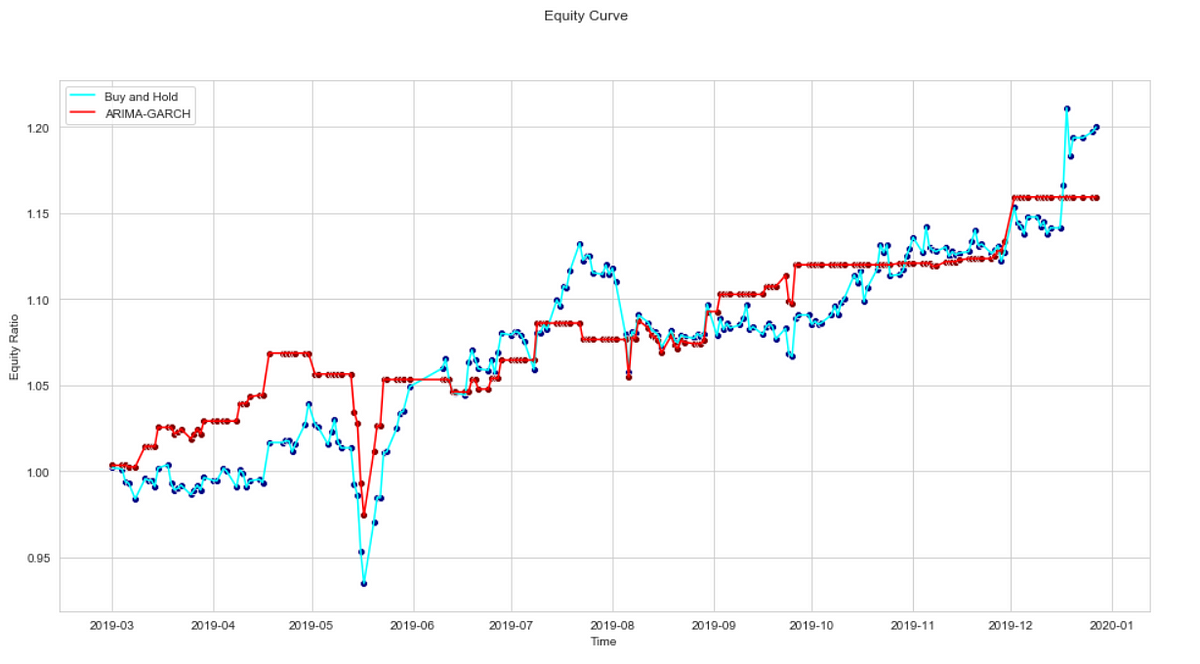

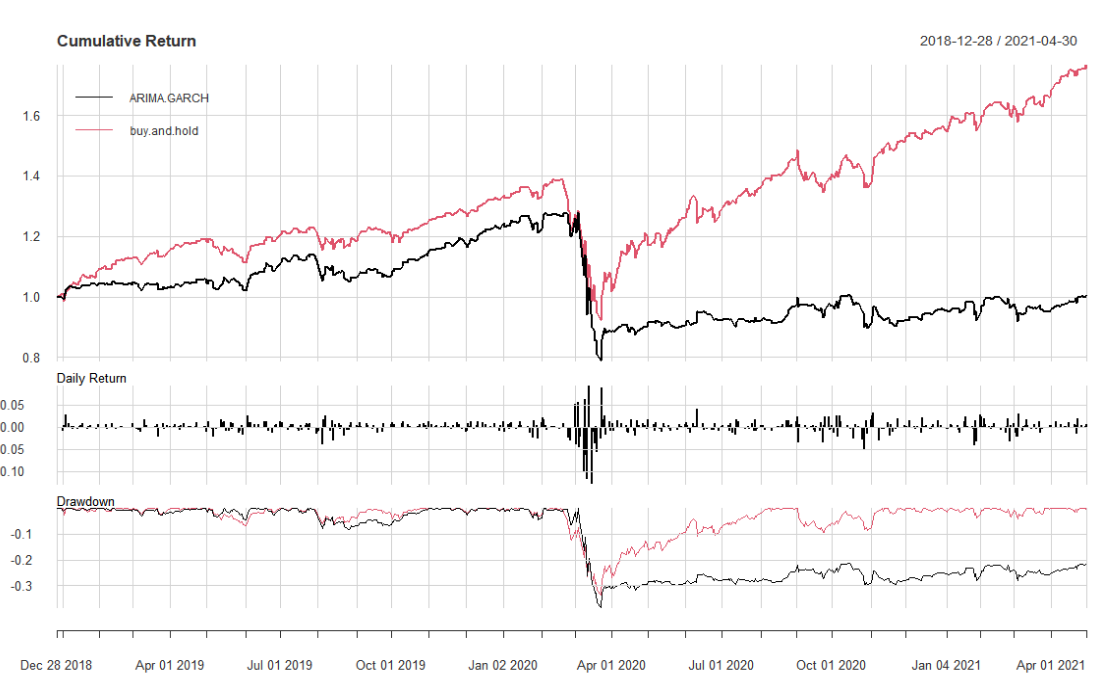

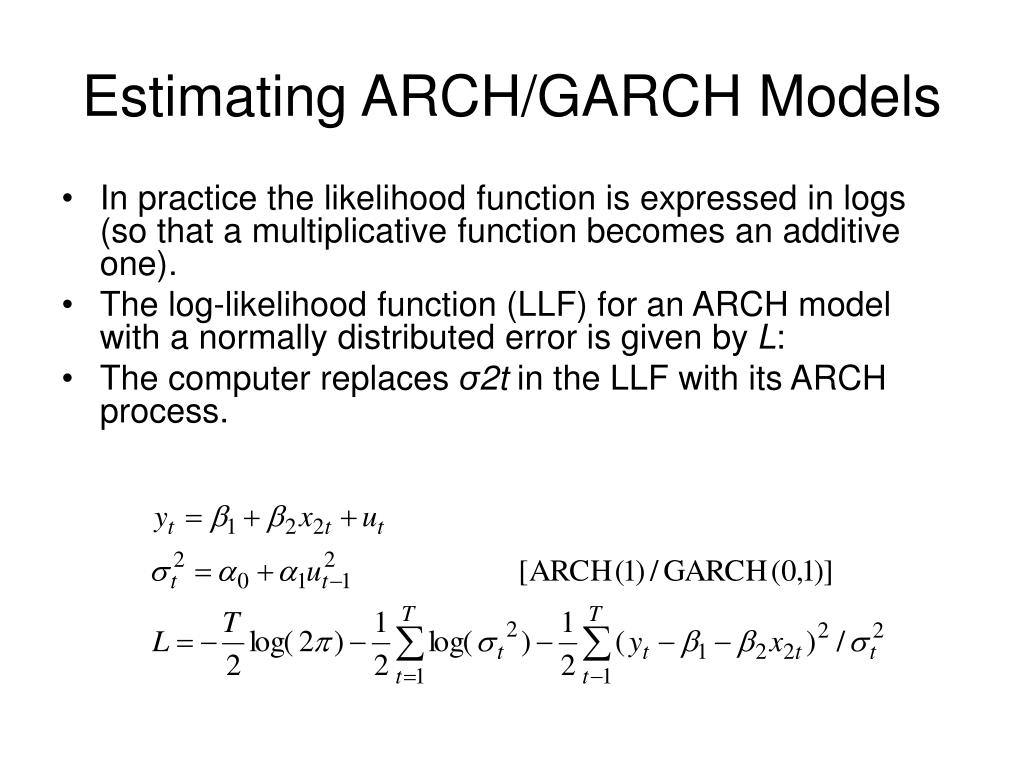

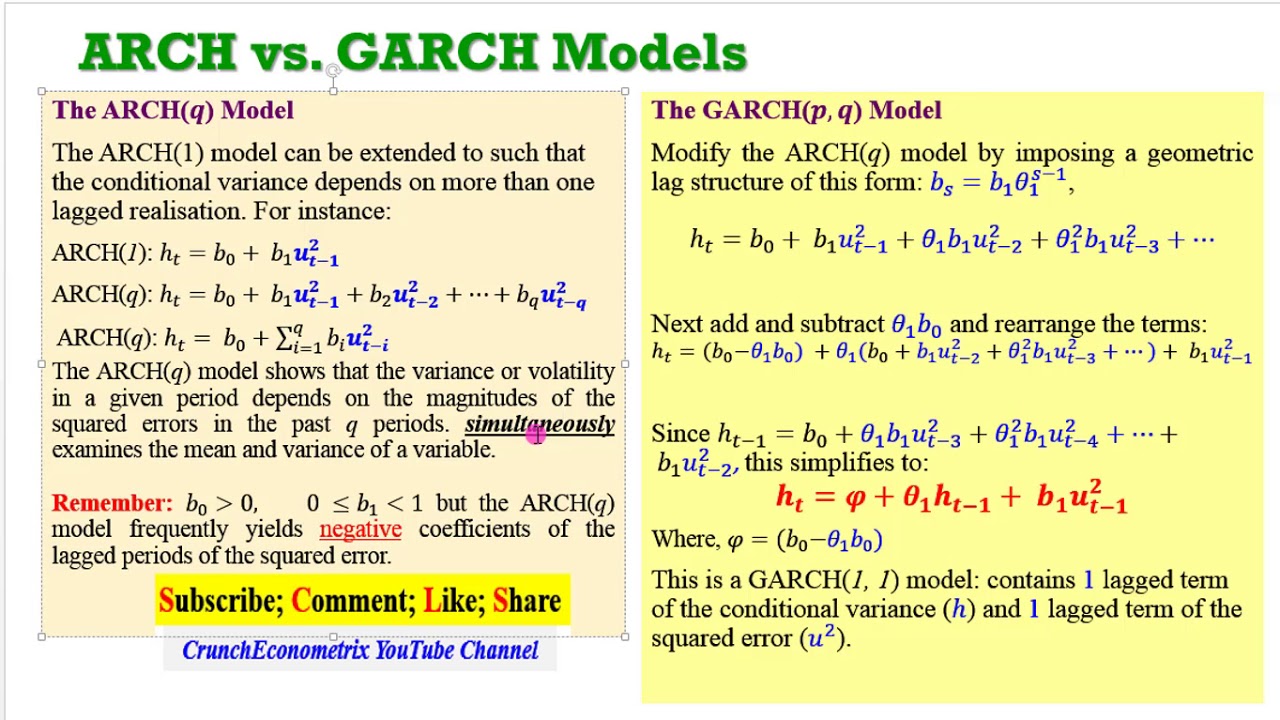

This post discusses the autoregressive integrated moving average model (arima) and the autoregressive conditional heteroskedasticity model (garch). For each day, n, the previous k days of the differenced logarithmic returns of a stock market index are used as a window for fitting an optimal arima and garch model. I am looking out for example which explain step by step explanation for fitting this model in r.

Pick the garch model orders according to the arima model with the lowest aic. Garch has also proven efficient for financial time series, since it can extract more complex patterns from a time series compared to arma and arima models. This model contains an lstm input layer which.

Arma(1, 0) ( 1, 0) with the ar coefficient >1), not necessarily an arima. Additionally it provides a comparison of two models: Forecast using a chosen model which is arima (auto regressive integral moving average) model in our case.

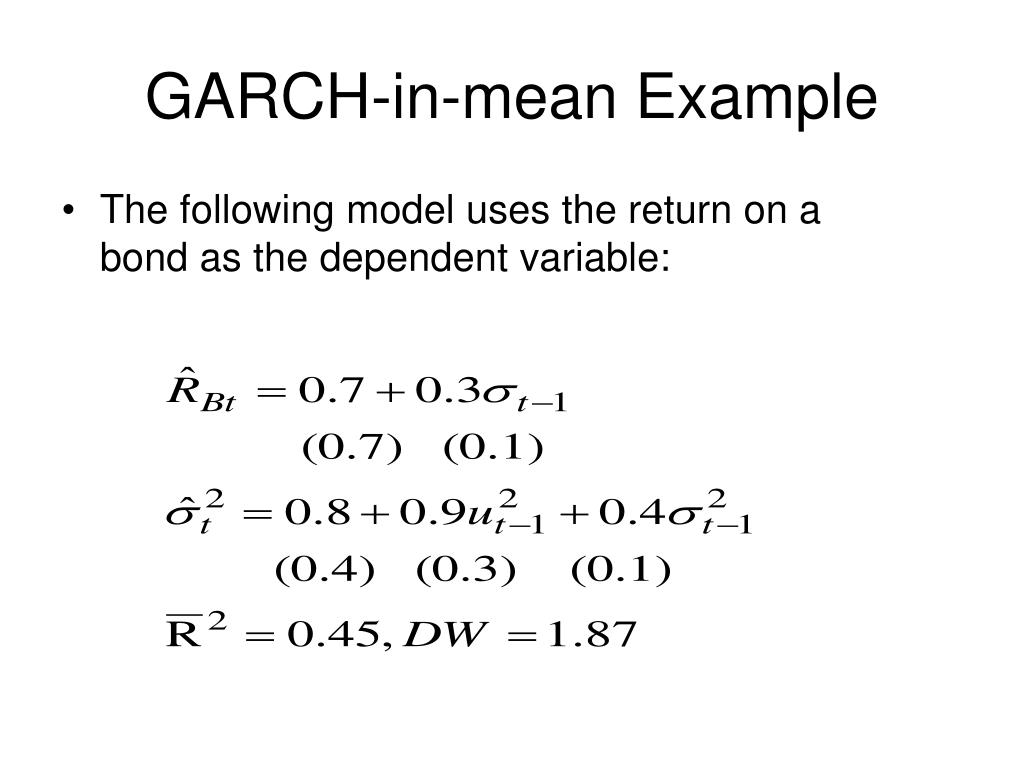

Arch models (garch is just a more general. This article serves as an overview of a powerful yet simple model known as arima. Describing the behavior of a time series is challenging for a quantitative researcher because there is a phenomenon of volatility clustering and.

Auto regressive integrated moving average (arima) models and a similar concept known as auto regressive conditional heteroskedasticity (arch) models will. Then forecast its volatility(residuals) using a. When it comes to financial time series (ts) modelling, autoregressive models (models that makes use of previous values to forecast the.

Iterate through combinations of arima(p, d, q) models to best fit our time series. In this paper, we introduce a hybrid approach using the arima and lstm models collectively. Models we will implement are as follow: autoregressive integrated moving average model, arima.

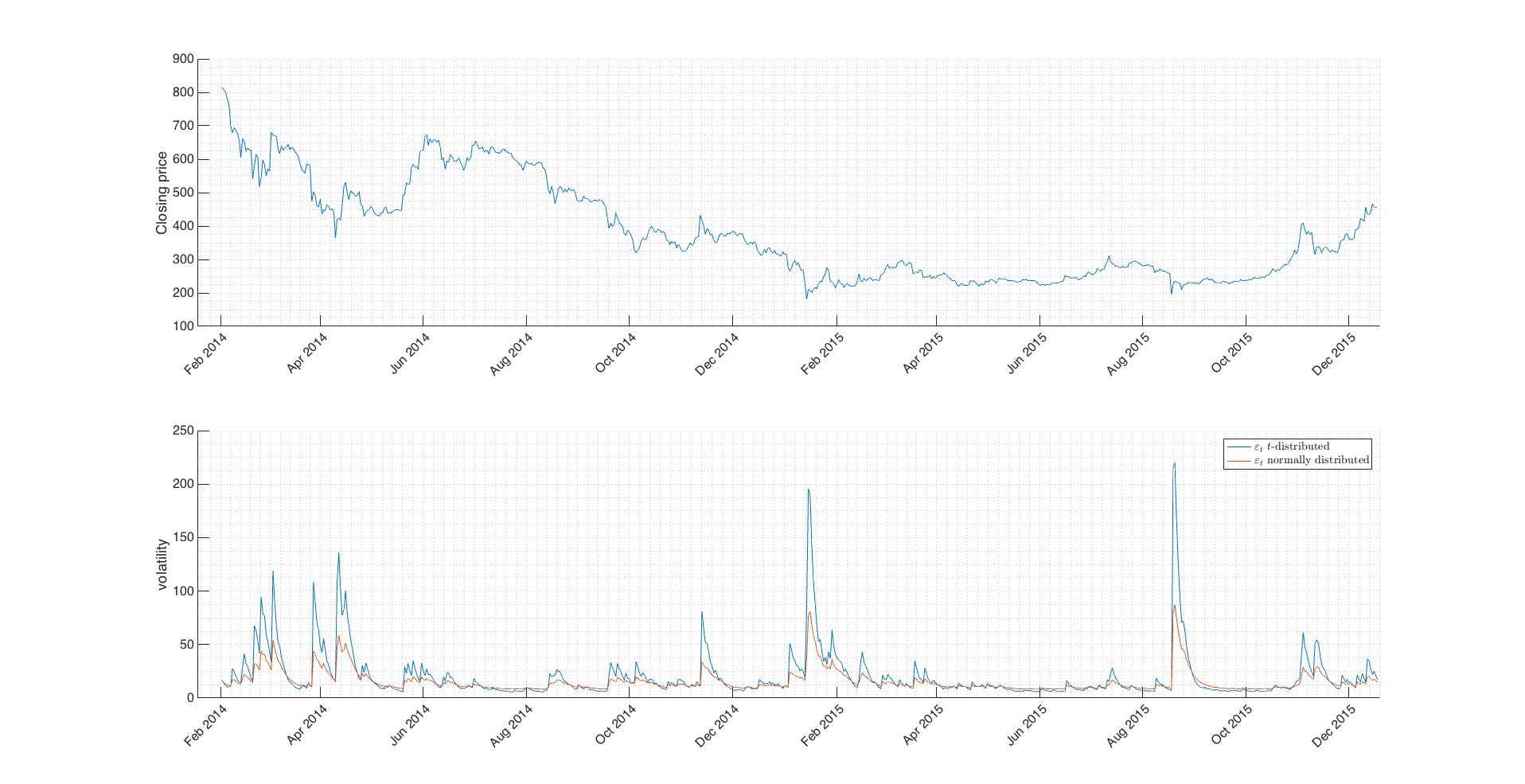

A nonstationary arma can be just that, a nonstationary arma (e.g. Below you can see the volatility forecasts after fitting an arch (11) model on the s&p500 price returns.

:max_bytes(150000):strip_icc()/GARCH-9d737ade97834e6a92ebeae3b5543f22.png)