Build A Info About Is Garch Better Than Arima Add A Second Data Series To An Excel Chart

Anyway my question is this.

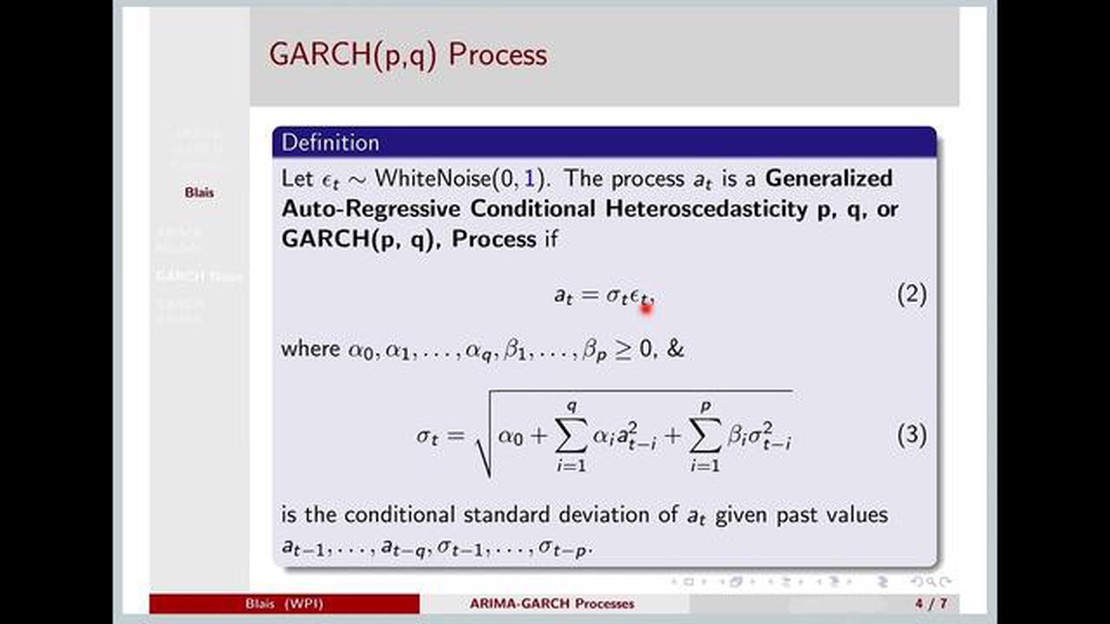

Is garch better than arima. Hansen and lunde (2005) concluded that hardly anything beats a garch(1,1) for a stock and an exchange rate. How does a hybrid model work. If i used an arima process to model the.

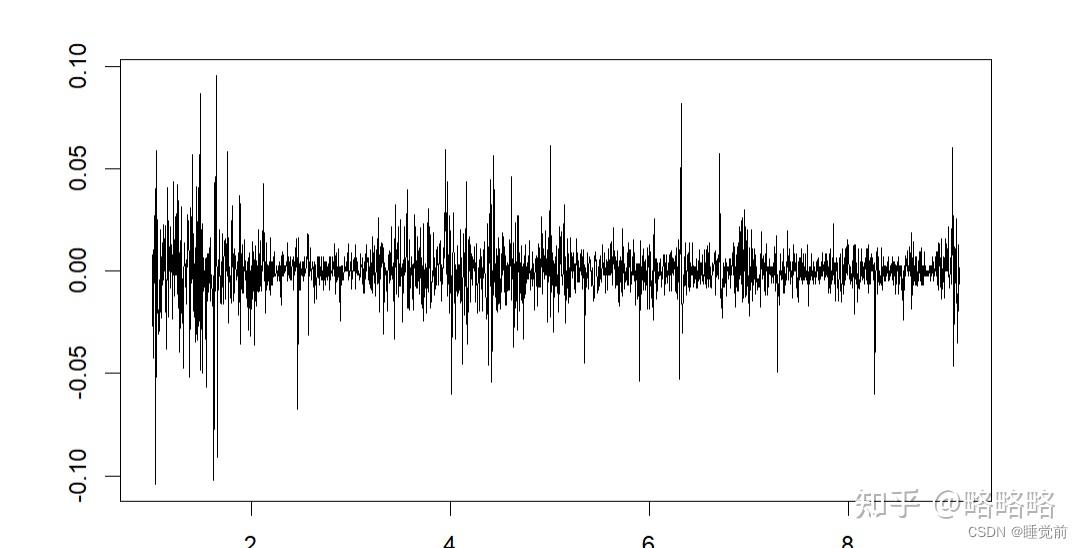

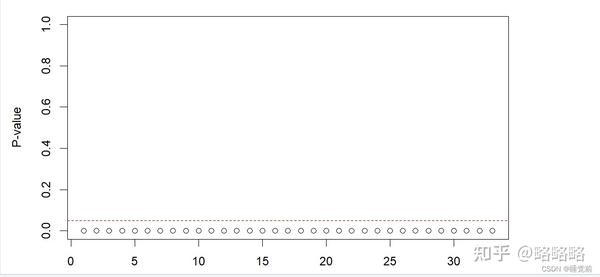

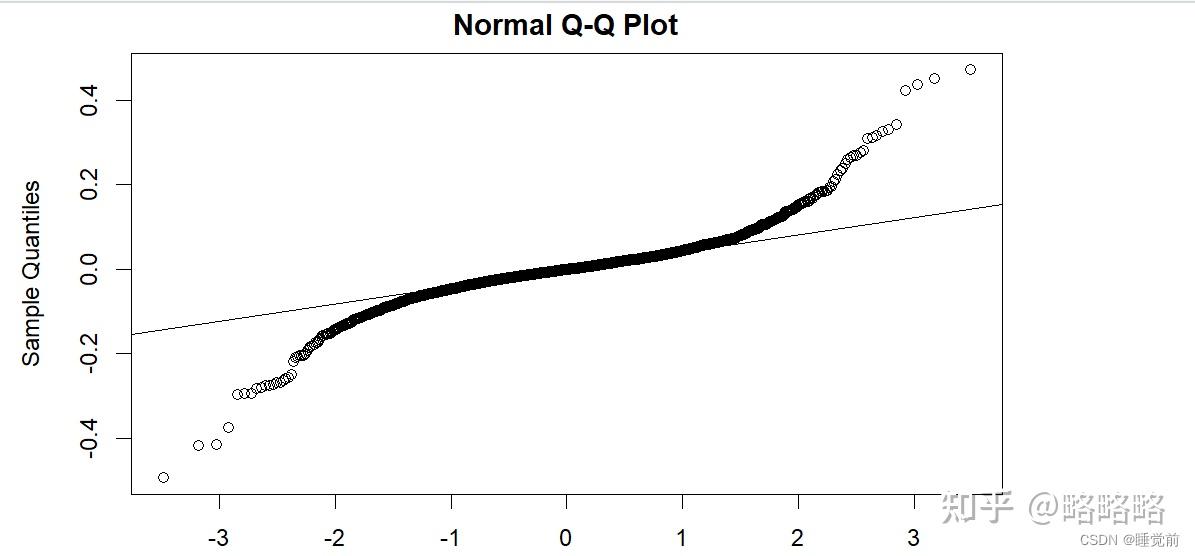

This can be verified by conducting the lagrange multiplier (lm) test [28, 34]. Arima models are able to measure relationships on our time series data that have both long term trends (ar) and sudden disruptions (ma). Garch is proven to have better performance than arima if the data have high volatility.

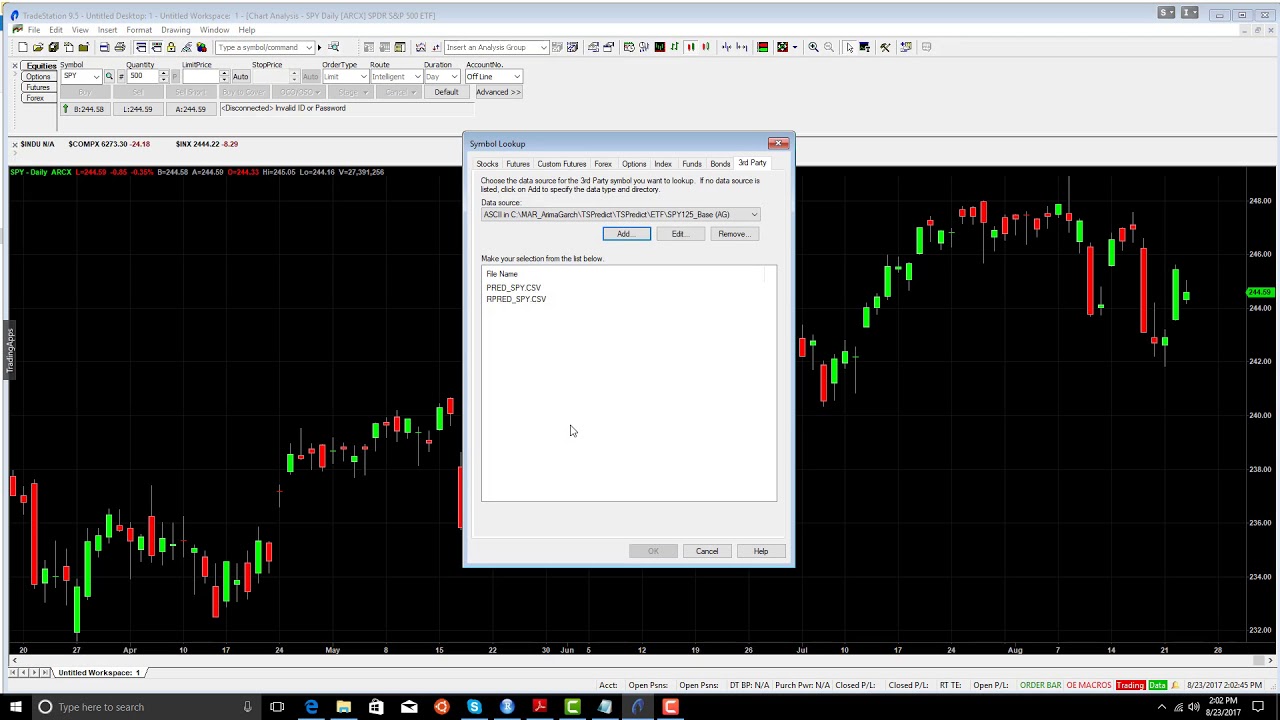

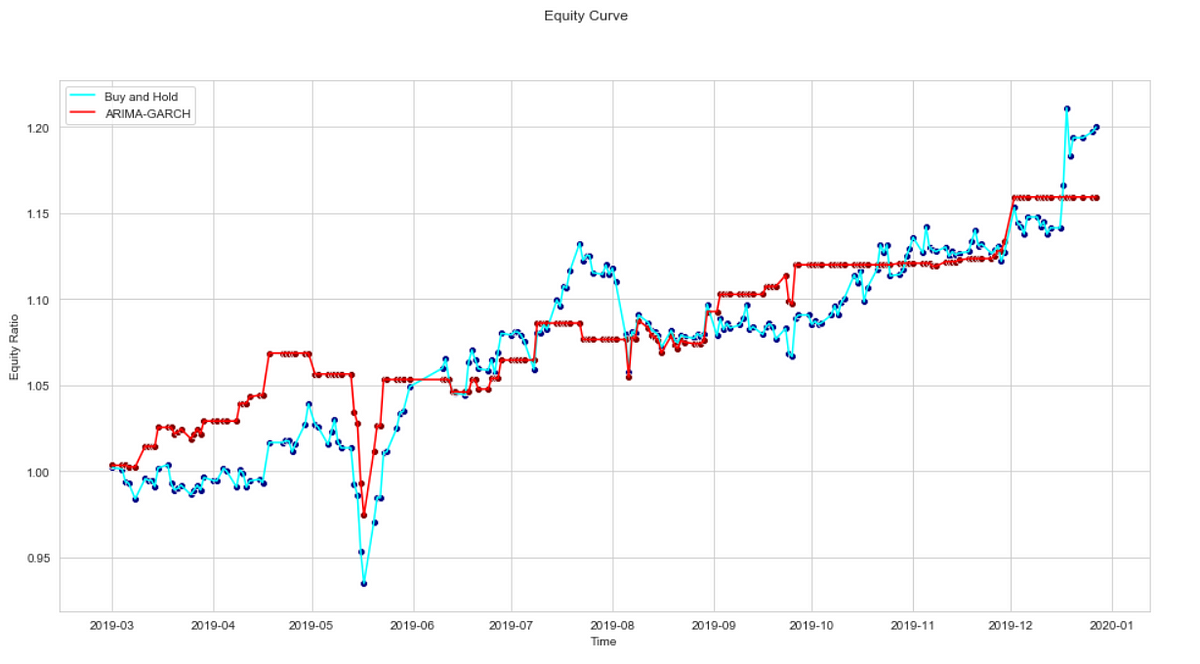

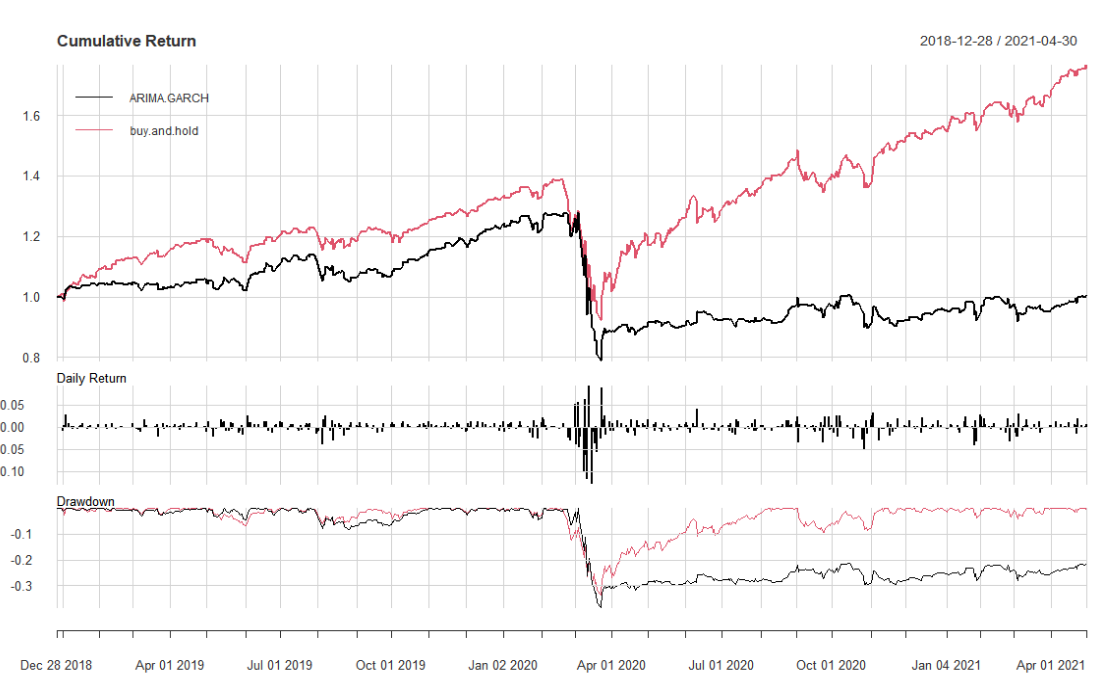

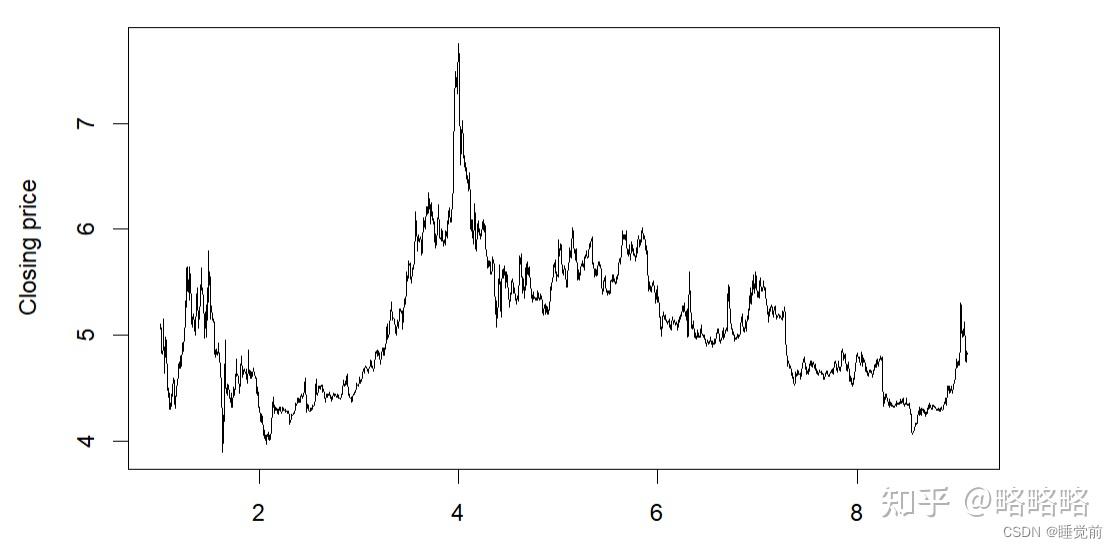

I found out now that the garch model on python requires the raw data, and not the volatility data. Autoregressive integrated moving average (arima) models are used to model and forecast a time series process. Equity curve of arima+garch strategy vs buy & hold for the s&p500 from 1952.

When it comes to financial time series (ts) modelling, autoregressive models (models that makes use of previous values to forecast the future) such as. The final prediction is given by combining the output of the arima model (red) and garch. By observing the results, we can find that the prediction of the ann model tends to predict the numerical value of the.

But this conclusion could be re markedly different for another. As you can see, over a 65 year period, the arima+garch strategy has significantly. The model choices are arima (1, 0, 0) and ann (10, 17, 1).

Forecast using a chosen model which is arima (auto regressive integral moving average) model in our case. Arch/garch models, especially relative to the utility of the.

:max_bytes(150000):strip_icc()/GARCH-9d737ade97834e6a92ebeae3b5543f22.png)